What you can learn about agency business life from riding a bike from the UK to Germany?

October 8, 2020

How an hourglass can help you retain information

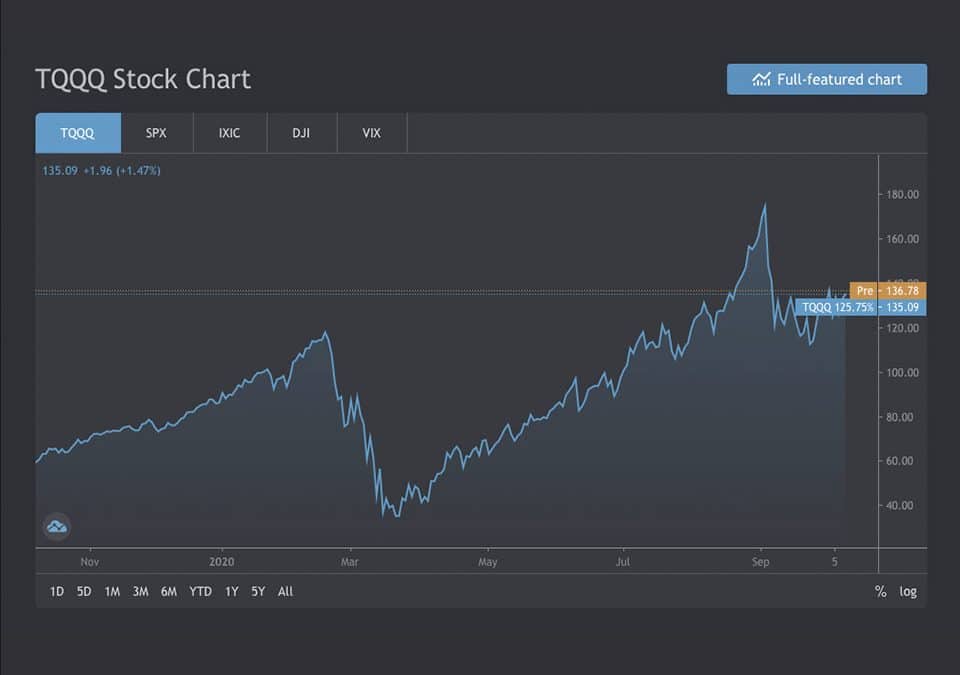

October 12, 2020You lose £1,000 one day, the next day you lose another £1,000, the next you make a few £100 back, then you lose another £1,000… by end of the month you had around £30,000 of losers. Would you have kept going or stopped somewhere along the way? (I’ll share the result at the end.)

The number of losses day traders endure in a day, is something most agency leaders don’t go through. You might lose a client or team member now and then. But imagine losing a client or team member every single day.

Would you hold onto your strategy? Would you hold onto your belief that it’s the right strategy in the long term? Or would you question yourself? Falter to the stresses that come with losing or the fear of losing. Two trauma triggers that sit deep inside us all.

Why are we are afraid of losing?

This is a really obvious question to answer on a top level. But what happens in your body and brain is complex. Tied to different levels of trauma experienced over the years. Denise Shull - the author of Market Mind Games - describes these as ‘fractal feelings’. In simple words and in this context: Things we do over and over again to avoid pain, because we were once hurt.

An example of a ‘fractal feeling’

You’ve probably experienced the short burning pain from accidentally scraping your knuckles along the oven top, while placing a pizza into a pre-heated oven. The most common reaction is: You’ll be more careful next time, because you don’t want to feel that pain again. In more extreme cases of being burnt, you might be so afraid you won’t use the oven ever again.

The result of getting more comfortable with loss

The same translates to agency life. Imagine you lost a client because you took a risk that didn’t pay off in that single instance. If the loss was severe enough, you’ll probably never take that risk again - “it didn’t work for us”. But what is if the actual big win was just around the corner? Maybe that risk wouldn’t have paid out for the first 5 clients. But success with the 6th client would have paid for all the losses and generated a significant profit for you and for your client.

Jason Calacanis - a successful angel investor, entrepreneur and - recently shared in a podcast about Taking Intelligent Risks on Farnham Street - how his seed stage investment in Uber finally paid off (his original investment estimated to be less than $100,000 is now worth more than x1000). A lot of people forget that Jason has had to lose millions of dollars in 100s of startups he invested over the years, before hitting an UBER. But he also was confident that his plan would eventually workout or get him close enough to the goal to feel content with the risk / reward. He's obviously trained his brain and body to be more comfortable with loss.

How to get more comfortable with loss?

There are many ways you can learn to become more comfortable with loss. There are plenty of techniques out there, you’ll just have to figure out which one works for you. The first with understanding why you are so afraid of loss or struggling to deal with loss when it appears. There are lots of people who can help you discover that.

Below are some techniques that others have used in their journeys:

Decide how you ‘show up’

I recently spoke to Gold Medalists Rower Mark Hunter MBE, who said it’s your decision how you show up on the day. When you’re training every single day to be the best in your field, it’s inevitable that things don’t go your way. But how you deal with the set back is up to you. You can choose to let it take you down and build a pattern of avoiding calculated risk. Arguably you have to know yourself really well to make this strategy a true success - because you need to recognise when something is part of your plan and when the plan is not right. A fine balance.

Follow the 5 Stages Of Grief

Denise Shull, adds an additional view to the point above: “People are always trying to fix a slump by changing their thought process, but science shows us that everything we do comes from how we feel.” (Read the full article here: Leaders In Sport)

What she is referring to is acknowledging that the feeling of losing is part of the game. Losing a key team member in your team is part of running an agency. Losing out on the client project that was going to transform your agency is part of playing the agency game.

To help you run through the course of emotions associated to feelings of loss, there is a model known as the Five Stages Of Grief or the Kübler-Ross model, which states you go through a mix of emotions of the following when dealing with loss until you can fully move on. This is not a linear process, you'll be jumping between the emotions. But eventually you'll accept the loss and can move on (but also realise the next time you survived):

- Denial

- Anger

- Bargaining

- Depression

- Acceptance

Risk Reward Ratio

Most good traders don’t look at their P&L, they use a Risk Reward Ratio when placing their bets. The reason is that the more money you see on the screen being lost or won, the more likely it will be you will start questioning your plan.

Keep a cooky jar

Try out uncomfortable things deliberately - it's scary I get that. Most people probably hate the idea of an ice cold shower early in the morning. Apart from the health benefits associated (check out Wim Hoff for some rather different level cold therapy) - taking a cold shower will help you build a ‘jar’ of experiences ‘cookies’ that you can refer back to when you experience loss or go through a tough moment. Because how much worse than having a cold shower each day can it be??? The cookie jar concept is one extensively explored in David Goggin’s book - Can’t Hurt Me.

Scenario planning

In our book club at Polymensa, we recently read the book Uncharted - How To Map The Future by Margaret Heffernan. The book explores the fact that nothing is 100% certain (although the Copenhagen Interpretation experiment might disagree). It also talks about how to deal with uncertainty. There is a whole chapter on scenario planning which is a good way to prepare your agency for the inevitable loss. Create a plan that has ‘what if’ scenarios, ranked by impact to the business. Add how you will react to the emotions when these scenarios appear.

The loss that turned into a winner

After week 3, while losing more than a £1,000 each day, you also have a couple of trades that validate your plan and you make more than £1,000 each day. At the end of the month you make £40,000, but lost £30,000. Your profit = £10,000.

Sign up to our newsletter for more daily learnings.

“Be an infinite learner”

References and additional sources to expand your mind:

Denise Shull - Market Mind Games

Margaret Heffernan - Uncharted: How To Map The Future

Steve Ward - Bullet Proof Trader

What I Learnt Losing A Million Dollars

Jason Calacanis - Intelligent Risks (Farnham Street Podcast)